Driving without car insurance in Illinois could lead to significant consequences including financial loss and suspension of driving privilege. It is therefore necessary to abide by law by paying the imposed requirements. For that purpose, Illinois driver’s pay an average cost of $1,648 per year for full annual coverage, that is nearly $160 per month. For the minimum charges, the average annual cost of car insurance in Illinois is $456 yearly, or nearly $35 per month on average. The difficult exercise actually is for Illinois citizen to get a car insurance which will provide price rates with important benefits or good discounts. This review proposes some of the car insurance group which have been evaluated to offer possibility for good savings.

1.Erie

it has been operating since 1999 in about 12 States including Illinois. Erie car insurance in Illinois provides good coverage with extra policy features that support customer needs through flexible charges. It is considered to offer appealing customized policy with easy understanding, hence fitting client needs. It has a good financial stability, and scores good rate for customer service, these are reasons enough to believe it is a good insurance company. Erie offers affordable minimum coverage for car insurance in Illinois, that is approximately $450 per year. It is also a good choice for drivers with poor credits, proposing less annual average coverage. Erie does offer important discounts with some special plan depending on customer choice.

Learn more: https://www.erieinsurance.com/auto-insurance/illinois

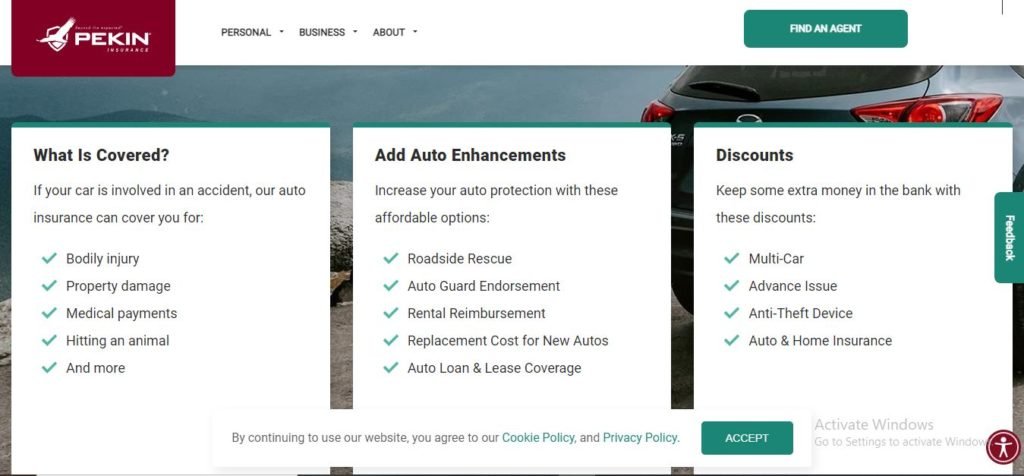

2.Pekin

It might not be that much known, but it is a company to consider for certain reasons. For example, Pekin car insurance in Illinois does offer lower annual coverage for good drivers sustaining a significant discount of about $600, a huge difference compare to the Statewide cost. Drivers with speeding tickets can also benefit for its cheapest annual rate as well which is 50% lower than the state normal cost and is the lowest in the group. The last but not the least is the case of drivers who caused accident with injury, Erie does stand for the same with the lowest possible. Some of its additional endorsement include Roadside rescue, Auto guard endorsement, rental reimbursement and replacement cost for new cars.

Learn more: https://www.pekininsurance.com/personal/auto/auto-insurance

3.Geico

If you worry about shopping around you overall income, consider this company. Geico car insurance in Illinois is one of the most stable with good financial strength, it is also a great choice for its good customer service. Apart from its usual lower premium charges, it is known to provide important discount for some categories including military employees, safe drivers or federal employees. It is a good choice as well for teen drivers, because of its most affordable rate proposed for this group, it is far the most lower with significant different in comparison to the state cost. Young Adult drivers are also good beneficiary of its cheapest cost, with an important difference with close competitors and state average cost.

Learn more: https://www.geico.com/insurance-agents/illinois/

4.Country Financial

Its presence in our list is because of its highly customized policy offering various possibility for client to choose the suitable one and gain in some aspects. Even though Country Financial car insurance in Illinois has a higher cost for premium coverage, it offers lowest quotes for some categories. For example, drivers with poor credit are welcome to get an estimate annual coverage which is below the normal state price. It is also the most solicited for parents adding teen drivers in their insurance policy. Its rating for senior drivers is the most appreciable, with annual coverage quite smaller than statewide range. An important fact about country Financial is the possibility it offers for car replacement under 5 years of usage.

Learn more: https://www.countryfinancial.com/en/about-us/who-we-are/where-we-do-business/illinois.html

5.State Farm

It is a usual name, always present among cheapest if not best car insurance companies. This frequent presence is a result of its great financial stability, good customer service and an overall reputation built over the years through its wide range of offers and strong financial support. State Farm Car insurance in Illinois is the best choice for Drivers with DUI, its provides this group with lower increased compared to the state increased rate which is high. Drivers of this category will benefit from an increase of only 8 to 9% compared to the 82% imposed by the state, very good deal. It is also a good choice for drivers who have caused accident as well, its rate might not be, the smaller, but it is the second affordable, hence can be considered.

Learn more: https://www.statefarm.com/local/illinois

Read also: Best and cheapest Car insurance in Wisconsin for 2022, Best Car Insurance in Florida for 2022, Best Auto insurance in North Dakota in 2022, 05 best inexpensive Car Insurance in Missouri