The average cost for car insurance in West Virginia is about $650 per year for minimum liability policy, a cost which is about 20% expensive than the National average for the same. That is too bad, because after all, it is considered to be 22th of 50 most affordable car insurance in the country. It is compulsory for all drivers in West Virginia to be insured and to always carry with them the necessary proof, the reason is people do drive here more often and there is an increased of accidents, claims, payout raising consequently, it affect seriously the cost of car insurance. However, there are important number of insurance companies available to offer affordable rates depending on factors involved.

1.State Farm

It is one the largest company in U.S dealing with insurance. It has a predominant notoriety which has improved seriously over the years and has made it one of the best car insurance in West Virginia and other States as well. It commutes with customers through its good rate, offering the lowest minimum liability, it enhances West Virginia citizen to benefit from a sense of shopping around their budget. Its minimum coverage average is about $350, that is 50% lower than the State actual price. Drivers with DUI are welcome to gain from the affordable charge provides by state farm, allowing them to pay $1,100 less than the average cost imposed by the State. It stands as well for drivers with prior accident case who also pay less than the normal average cost in West Virginia.

Learn more: https://www.statefarm.com/local/west-virginia

2.Nationwide

It is another big company, proposing quality service all over the country, with interesting financial stability. It proposes affordable minimum liability coverage for car insurance in West Virginia, and its rates for various criteria seem to be very low, a sign that you can get a convenient policy with Nationwide through little effort. Just like its name, it is a family insurance, providing profitable annual coverage for parents who want to add their teen drivers in their insurance; with an added increase of nearly 41%, the total average rate paid for this case is still lower than the State cost. Nationwide offers possibility for other benefits such as car repair or replacement of any sort, accident forgiveness, option which could reduce charges considerably.

Learn more: https://www.nationwide.com/personal/insurance/auto/state/west-virginia/

3.Erie

It is not that extended compare to the above mentioned, but its strong financial basis has provided a good reputation wherever it is represented. Erie car insurance in West Virginia works close to clients with customized policy which fit their needs at different levels. It offers a cheaper cost for full average annual coverage, enhancing good saving. Its rate for accident at-fault drivers is also one of the best proposing a reduced amount of nearly $400 for the State normal coverage for the same. This company provides West Virginian with a massive benefit, including coverage of lost or damage of personal items in case of accident, no-deductible glass repair, and discounts like accident forgiveness, multi-policy discounts and many more.

Learn more: https://www.erieinsurance.com/agencies/wv

4.Geico

It is another large company with important popularity rate and good reputation, it has been in the market for quiet long time and has built up a very strong financial background. It is good option for people looking for good car insurance in West Virginia. It provides interesting minimum coverage cost as well, quite affordable, but the only inconvenient is that there is no discount apply for individual wishing to pay in full, and also for online processing. However, it proposes discounts for bundling car and home policy, multi-car discounts and many other common discounts usually offered. Geico offers the second cheapest average annual rate for good drivers who will have to pay about $400 less that the state average cost.

Learn more: https://www.geico.com/information/states/wv/

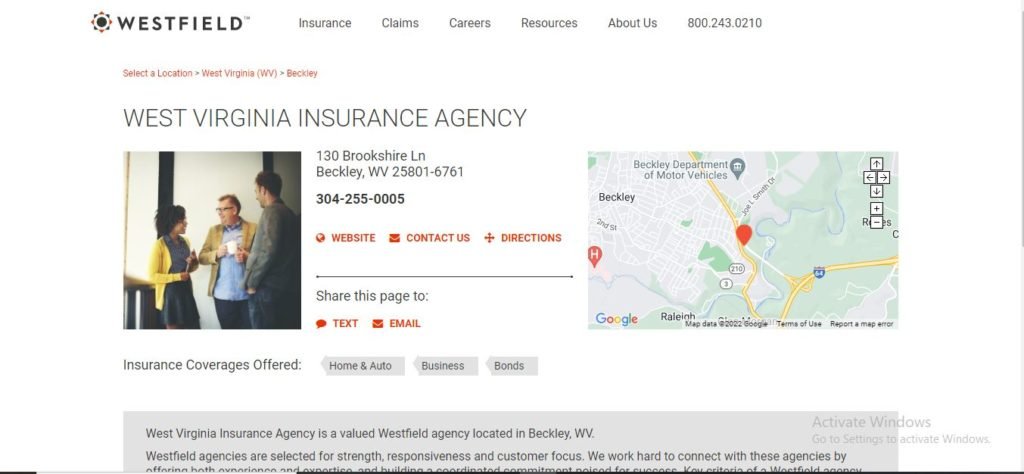

5.Westfield

It is not that famous, and does provides car insurance only in ten States including Iowa, Illinois, Indiana, Pennsylvania, West Virginia, Kentucky, Ohio, Wisconsin, Minnesota and Tennessee. It does provide commercial insurance to the other States where it is represented. Westfield is a good car insurance in West Virginia providing the third lowest average for full coverage, with a significant difference compare to the State range. It offers the second cheapest rate for driver having speeding ticket, who will rather pay 10% less than the state imposed rate. So is the same for good drivers and young drivers who do benefit as well for its most affordable rate which is really competitive with important reduction.

Lear more: https://www.westfieldinsurance.com/

Read Also: Best Car Insurance in Maine 2022, Least expensive car insurance in Indiana 2022, Most Affordable Car Insurance in Kentucky 2022, Best Car Insurance in Oklahoma for 2022, 06 best Car insurance in Tennessee, Best and Cheapest car insurance in Virginia 2022