Car insurance in Delaware tends to be expensive even though it is not that large. In fact, population congestion in a small area of Delaware leads to high density, more accidents and costly repairs; these are three aspects causing car insurance to be costly. Drivers have to pay an average annual cost of $1,750 per year for full car insurance coverage, about 20% expensive than the national average cost. The State average minimum coverage is about $780 per year which is also quite expensive than in other States. However, car insurance depends highly on every individual condition, and there is a possibility to find an insurance which does offer convenient rates with chances to make good savings.

1.Travelers

It is one of the best insurance company in US with an overall score of 4 out of 5 for its quality service. It has strong capacity in dealing with claims, probably because of its robust financial level. In general, Travelers offers interesting annual premium coverages which are constantly less than the national average. As a car insurance in Delaware, it is a great deal, proposing the second least expensive average annual coverage with a reduction of about 10% compare to the State average. It is a good choice for drivers with speeding ticket who do obtain an average coverage charge paying about 20% less than the State cost. In case of accident, Travelers offers coverage such as road assistance, gap insurance, accident forgiveness, new car replacement and more.

Learn more: https://www.travelers.com/car-insurance/state-coverages/delaware

2.Geico

Ranked at the third position for best insurance in US, Geico is well known for its good financial strength, absolute efficiency in solving claims even though the customer service has an average score for performance. It proposes for car insurance in Delaware, the best overall performance, providing interesting rates in many categories. For example, it offers affordable minimum coverage rate which is about 10% less than the State cost for the same. This give an opportunity for car owners in Delaware to make important saving while shopping around on budget. Geico proposes affordable policy for good drivers, drivers with poor credit and young drivers who obtain the lowest rate. It provides important discounts as well, for all group of individuals.

Learn more: https://www.geico.com/information/states/de/?gclid=EAIaIQobChMIpvXNiuG2-QIVppBoCR2pFgHsEAAYASAAEgKV2PD_BwE

3.Nationwide

It is one of the largest and strongest diversified insurance and financial service organizations in U.S.. Although its customer service remains a concern, it is provided with important tools which do help stand tall with important rates in every state where it is established. Nationwide car insurance in Delaware is highly recommended for high risk drivers such as those with DUI, with at-fault accident or speeding violation, probably because it proposes, an affordable policy for these groups with an important rate providing some sort of reduction compare to the State cost. It is a good choice for parent who need to add teen drivers in their insurance policy, providing the lowest rate with an increase rate of about 40% which is lower than that of the state.

Learn more: https://www.nationwide.com/personal/insurance/auto/state/delaware/

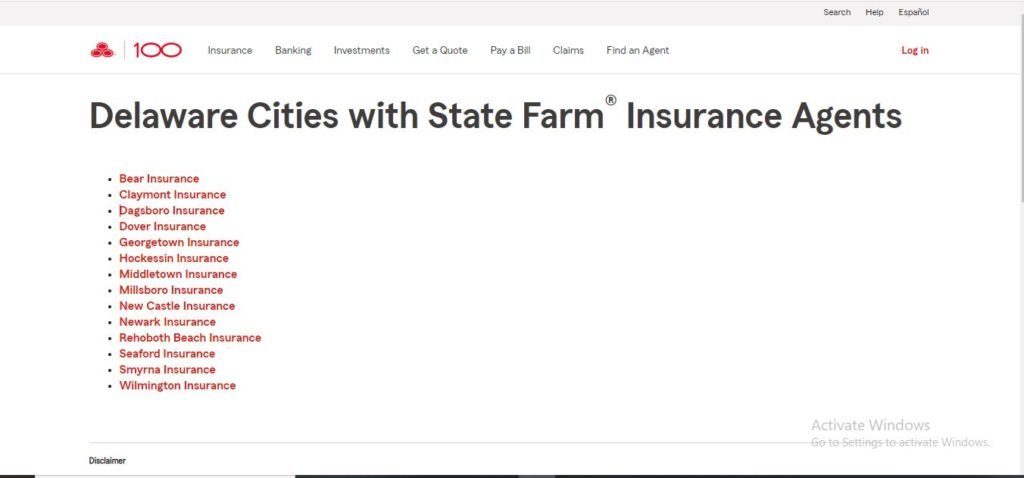

4.State Farm

With a market share of almost 15%, state Farm is one of the largest insurance company in U.S., following USAA which is an exceptional company for Military and relatives. State farm is usually appreciated for its rapid payment of claims, and overall support provided for customers. It provides for car insurance in Delaware, cheap minimum coverage with a reduction of nearly 10% from the State cost. It is a good choice as well, for drivers who opt for full coverage, as they will be paying about $1,350 or $109 per month, which is approximately 40% cheaper than the state coverage for the same. It is also a good option for young drivers as they will be paying an average which is estimated with a 30% reduction compare to the normal average in the State.

Learn more: https://www.statefarm.com/local/delaware

5.Progressive

It is another well rated insurance company with appreciable service at all level. Progressive is mostly known for its interesting policy for high-risk drivers. It is ranked as the third largest auto insurer providing services to important number of drivers yearly. It provided better policy for car insurance in Delaware. Drivers with DUI can gain for its cheapest policy offering the cheapest annual coverage with 10% difference compare to the State cost. Its charges for drivers with poor credit might be the cheapest, considering that it is lower than the state cost, it can be advised for some individuals. It offers important discounts such as lease or loan payoff, good student discount, student away at school discount, continuous coverage discount, online quote and more.

Learn more: https://www.progressive.com/answers/delaware-car-insurance/

6.Root insurance

It is one of the youngest insurance in this list, established in 2015, it is available in about 34 States including; Alabama, Delaware, Connecticut, Indiana, Maryland, Nevada, New Mexico and others. Root insurance makes a difference through its important discount percentages; customer can get this from its premium, and also it does not insure drivers with bad records. It provides for car insurance in Delaware, exceptional coverages including rideshare coverage, gap insurance, bundling home and car insurance with possible discount, specialized vehicle insurance for ATVs, commercial and business car insurance. Its mobile app is an important tool for monitoring the driving records before providing any convenient policy.

Learn more: https://www.joinroot.com/availability/delaware-car-insurance/

Read Also: https://carsnjeeps.com/auto-insurance/best-car-insurance-in-connecticut/, Most affordable Car insurance in New Jersey 2022, Best car insurance in New Hampshire 2022, Cheapest Car Insurance in Iowa 2022, Most Affordable Car Insurance in Arkansas 2022